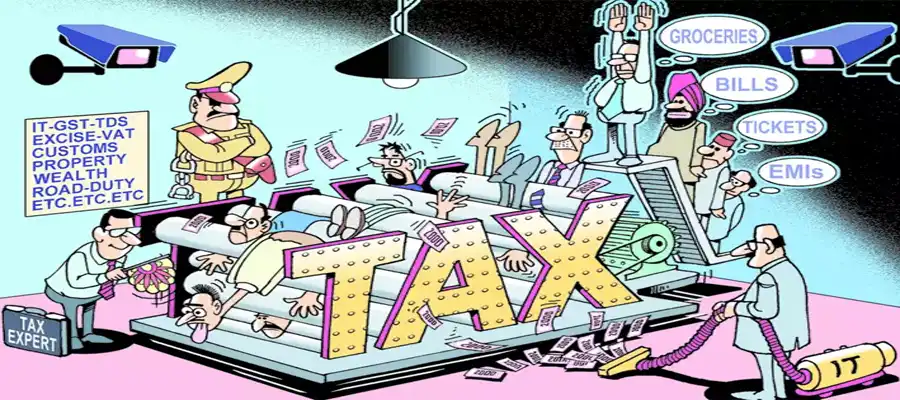

The debate over whether India’s billionaires contribute their fair share in taxes, or if the fiscal burden disproportionately falls on the common man, remains a contagious issue. While billionaires and large corporations assert their role in driving economic growth through investments and job creation, critics argue that their tax contributions are minimized through systematic loopholes and tax avoidance strategies. Meanwhile, the common populace bears a significant burden through indirect taxes like the Goods and Services Tax (GST), which tend to impact lower-income groups more heavily.

According to the Oxfam India report released in 2023, the richest 1% of the population of India owns more than 40% of India’s wealth, while millions struggle below the poverty line. This disparity sharpens the debate about the role of billionaires in India. Are they, indispensable contributors to national growth, or do the liabilities of their wealth and influence evade accountability?

The stakeholders in question

India’s billionaires and high-net-worth individuals (HNIs) wield substantial influence, often sharpening industries, markets, and policies. While many contribute to economic growth and philanthropy, others have been accused of exploring loopholes, evading taxes, and even renouncing Indian citizenship for personal gains

India’s Tax system, an overview

India employs a progressive tax system for individual taxpayers, where higher incomes are subject to higher tax rates. Corporate taxes are also imposed in business. However, the structure often favors those who can exploit legal loopholes:

- Corporate tax rate: for domestic companies, the tax rate is approximately 25%, with certain exceptions for new manufacturing companies.

- For income tax for individuals, the highest tax bracket for the bracket of individuals is 30%, excluding the surcharge.

- Indirect taxes; GST is levied on most goods and services, which can disproportionately affect the lower and middle classes.

Do billionaires pay their fair share?

India’s billionaires, while significantly contributing to the economy, often benefit from tax exceptions, incentives, and offshore arrangements. Key issues include;

Offshore tax havens

- Utilization of tax havens: many high-net-worth individuals (HNIs) use offshore tax havens such as Mauritius, Singapore, and the Cayman Islands to reduce their taxable income in India. According to a report by Global Finacial Integrity (GFI), India lost approximately $83 billion to illicit financial outflows between 2005 and 2014, much of it facilitated through tax havens.

- Shell companies: the use of shell companies registered in these tax havens allows billionaires to avoid taxes legally by routing investments through jurisdictions with lower tax rates. The Paradise Papers and Panama leaks revealed numerous Indian names linked to offshore accounts.

Corporate tax benefits

- Effective tax rates: although the statutory corporate tax rate is 25%, large corporations owned by billionaires often pay much less due to government incentives, exemptions, and deductions. For example, a 2022 report by Oxfam India noted that many large corporations had effective tax rates between 12-15%, significantly lower than smaller businesses

- Sector-specific benefits: Industrialised information technology, renewable energy, and export-driven sectors often enjoy special concessions. While these are intended to promote economic growth, they disproportionately benefit billionaires who dominate these industries.

High-profile cases

-

Gautam Adani: allegations have surfaced regarding the use of offshore entities for transactions, raising questions about transparency.

-

Mukesh Ambani: while Reliance Industries pays substantial taxes, its effective tax rate is often reduced due to legitimate exceptions and rebates.

-

Alleged fugitives like Vijay Mallay and Nirva Modi: these individuals have been involved in finance fraud cases, contributing to the perception of billionaires exploiting the system.

The common man’s tax burden

Indirect taxes

- GST serves as a significant revenue generator for the government and affects all consumers equally, regardless of income. This uniform application can make it regressive, disproportionately impacting lower-income households.

Limited relief or middle-income groups

- Tax rebates and exemptions for salaried individuals are often minimal compared to the benefits extended to corporations and HNIs. Rising inflation and stagnant wages exacerbate the financial strain on the middle class.

Comparative data: billionaire vs common man

-

Contributing to GDP: reports indicate that the richest 1% in India own a substantial portion of the country’s wealth, yet their contributions remain opaque.

-

Tax revenue: the total tax revenue from corporations and HNIs is often overshadowed by revenue from GST and other indirect taxes.

-

Wealth disparity: studies have highlighted the growing gap between the rich and poor, emphasizing the need for equitable tax policies.

Global comparisons

In developed countries, billionaires often face stricter tax regimes. For instance:

- United States: recent debates on increasing wealth taxes for billionaires have gained traction

- European Union; wealth taxes are more common, ensuring HNI’s contribute proportionately to national revenue.

India, however, lacks a specific wealth tax, relying primarily on income and corporate taxes.

Government initiatives to address tax evasion

-

Fugitive Economic Offenders Act (2018): this act allows the government to confiscate the properties of economic offenders who flee the country

-

Digitalization of Tax systems: Initiatives like faceless assessments and stricter reporting norms aim to curb tax evasion.

-

International cooperation: India has signed agreements with several countries to exchange financial information and combat offshore tax evasion.

Solutions for equitable taxations

- The government should introduce a wealth tax, taxing the super-rich on their net wealth could generate significant revenue.

- The anti-avoidance laws should be strengthened thereby closing loopholes in tax laws that can prevent evasion.

- The dependency on the indirect tax should be reduced while shifting focus to direct taxes can reduce the financial strain on lower-income groups.

- The policies should be framed to enhance transparency, requiring corporations to disclose detailed tax payments can build public trust.

Altogether, billionaires play a crucial role in India’s economic growth, and their tax contributions often fall short of expectations. The common man, meanwhile, shoulders a disproportionate burden through indirect taxes and limited relief. To achieve a more equitable system, India needs strict tax enforcement for every section of the people indiscriminately, thereby closing loopholes, and considering measures like wealth taxes. Hopefully, then can fiscal responsibility be balanced between billionaires and ordinary citizens.