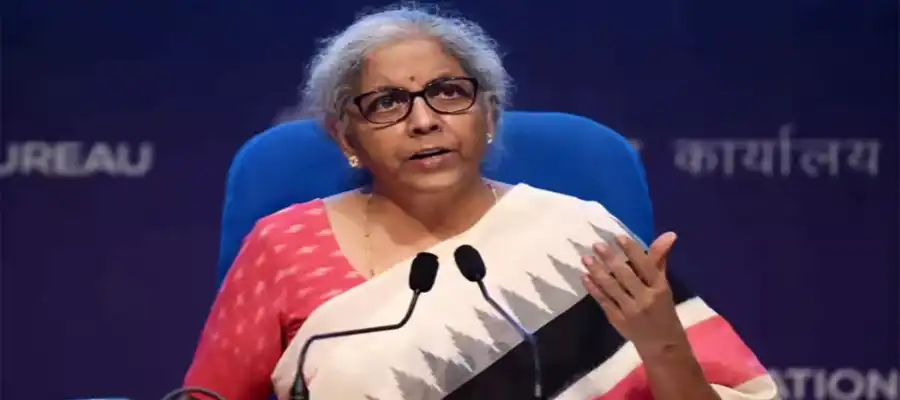

Finance Minister Nirmala Sitharaman has made many significant changes related to income tax in the budget of 2024-25. Some of the changes have already been implemented and rest of them will get implemented in the future. These changes will affect your income, savings and tax calculation, so it is important to be aware of these updated rules.

List of changed income tax rules:

1. Change in the tax slab

In the budget for 2024-25, the finance minister has made changes in the tax slabs under the new tax regime. With this change in the tax slab, salaried employees will now get an opportunity to save tax up to Rs 17,500 on an annual basis. However, no changes have been made in the old tax regime.

2. Standard deduction limit increased

In the new tax regime, the limit of standard deduction has been increased to Rs 75,000. Earlier it was Rs 50,000. Apart from this, the exemption on family pension has also been increased. Now the annual exemption on family pension will be up to Rs 25,000, which was earlier Rs 15,000.

3. New TDS rates

TDS (Tax Deducted at Source) rates have been reduced in the general budget. In many cases, the TDS rate has been reduced from 5% to 2% or 1%. This will give people an opportunity to save tax and the processes will also be simplified.

4. New rates of capital gains tax

Changes have also been made in the rules of capital gain tax. Now the tax rates on long term capital gain (LTCG) and short-term capital gain (STCG) have changed. STCG tax on equity and equity-oriented mutual funds has been increased from 15% to 20%. At the same time, LTCG will now be taxed at 12.5%, which was earlier different for different assets. Apart from this, tax exemption on LTCG for equity has been increased from Rs 1 lakh to Rs 1.25 lakh.

5. TDS on sale of property

If you buy or sell a property worth Rs 50 lakh or more, then you will now have to pay 1% TDS. However, if the property is being purchased jointly by several people and the share of any one of them is less than Rs 50 lakh, then TDS will not be levied on it.

6. TCS on luxury goods

Now 1% TCS (Tax Collected at Source) will have to be paid on the purchase of luxury goods worth Rs 10 lakh or more. Although the government has not yet clarified which products will be included in this, but it is expected that it may include items like designer handbags, luxury watches, designer home decor.

7. TCS credit claim made easy

It will now be easier for employed people to claim TCS credit. Apart from this, if a minor person claims TCS, then his parents can also claim that credit. This change will be especially beneficial for those parents who pay tuition fees for their children studying abroad but are unable to claim TCS credit.

8. NPS contribution increased

A good change has been made for the employees in the budget of 2024-25. Now the employer will increase the contribution of the employees to the National Pension Scheme (NPS) from 10% to 14%. This means that now 14% will be deducted from the basic salary of the employees. This will increase the retirement corpus of the employees and they will have to pay less tax.

The contribution to the scheme (NPS) will be increased from 10% to 14%. Now 14% will be deducted from the basic salary of the employees. This will increase the retirement corpus of the employees and they will have to pay less tax.

These changes will affect income, savings and tax calculation. Therefore, it is very important to understand these changes and implement them correctly.