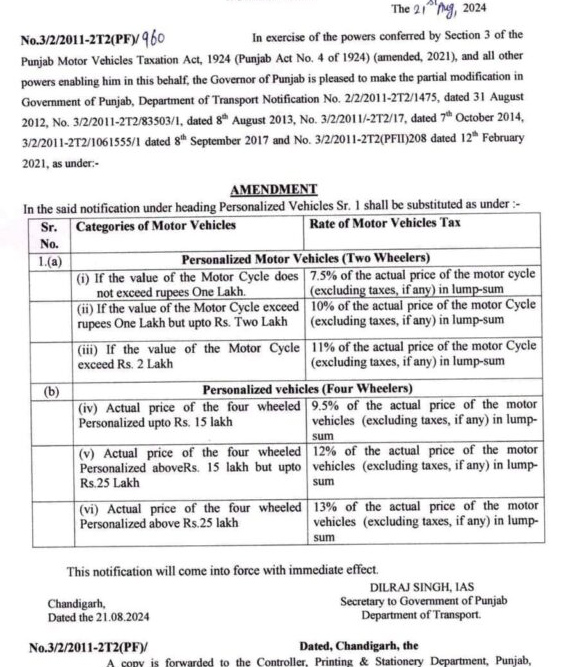

Buying two or four weehler vehicles is all set to get costlier in Punjab as the statement government as issued revised/increased motor vehicle tax. Punjab Government has also intricyed green tax concept that will be levied on private as well as commercial vehicles. Bhagwant Mann-governmnet has implemented new Vehicle tax slabs for registration of two and four wheelers in the state. According to information the registration fees has been increased by 1.5 to 2 percent for different categories of motor vehicles. Talking about green tax, the cost of vehicle registration in Punjab has increased due to the implementation of this particular tax. The new tax policy, which has been officially notified, applies to non-transport vehicles during the renewal of their registration certificates (RCs). Below is the breakdown of both vehicle tax & green tax and how it will impact the cost of cars or bikes in the state-

Punjab vehicle price hike after vehicle tax

As per reports, after the implementation of vehicle tax, buying a four-wheeler costing up to Rs 15 lakh will become expensive by anything between Rs 7,000 and Rs 20,000. The maximum effect would be on the vehicle costing between Rs 15 lakh and Rs 25 lakh, wherein the tax has been increased by 1 per cent.

For high-end vehicles like SUVs costing above Rs 25 lakh, tax at 13 per cent on the cost of the vehicle has been imposed. For a vehicle costing Rs 30 lakh, the tax would be Rs 3.9 lakh.

It is pertinent to mention here that the tax is on the actual cost of the vehicle excluding taxes.

Talking about two wheelers, taxes on bikes/scooter upto Rs 1 lakh has been increased by 0.5 per cent and for those costing between Rs 1 lakh and 2 lakh, the tax has been increased by 1 per cent. A new category has been made for high-end two- wheelers costing above Rs 2 lakh, wherein the tax is 11 per cent of the cost of the vehicle.

Green tax on Punjab Vehicles

Green Tax is a tax imposed on old vehicles as these vehicles cause pollution due to emissions from their old engines. The order issued by the Punjab government said that an annual green tax of Rs 500 will be imposed on non-commercial two-wheelers running on petrol and Rs 1000 on two-wheelers running on diesel. At the same time, an annual green tax of Rs 3000 has been imposed on four-wheeler non-commercial petrol vehicles with 1500CC engine and Rs 4000 on diesel vehicles. A green tax of Rs 4000 per annum has been imposed on petrol vehicles having power more than 1500CC and Rs 6000 per annum on diesel vehicles.

However, the Punjab government has given some leniency in imposing green tax on commercial vehicles. In transport vehicles, after 8 years, a green tax of Rs 250 per annum will be levied on two-wheelers, Rs 300 per annum on three-wheelers and Rs 500 per annum on motor cabs. Whereas a green tax of Rs 1500 per annum will be levied on light goods transport and passenger vehicles, Rs 2000 on medium goods transport and passenger vehicles and Rs 2500 per annum on heavy goods transport and passenger vehicles.