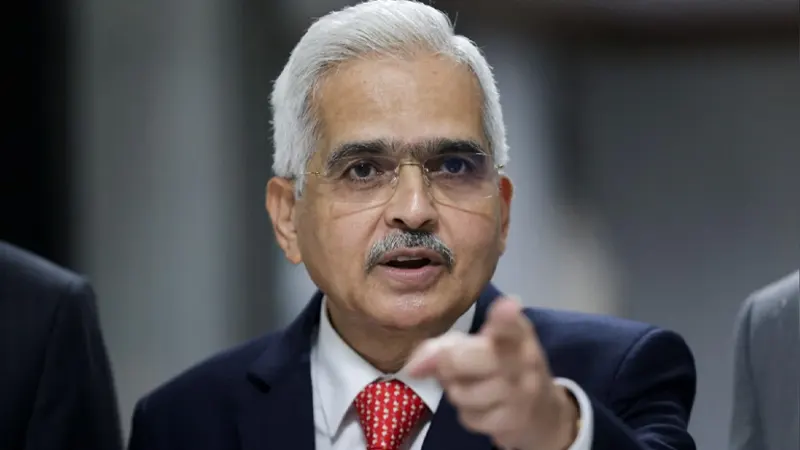

Governor of Reserve Bank of India, Shaktikanta Das, announced the launch of a new technological platform called the Unified Lending Interface on Monday, 25th August. This launch aims to revolutionize the lending sectors of India just like Unified Payment Interface did for payments.

At a global conference on “Digital Public Infrastructure and Emerging Technologies” in Bengaluru, RBI Governor, Shaktikanta Das said “Just like the Unified Payments Interface changed the payments ecosystem, similarly we expect ULI to transform the lending landscape.”

RBI realized that currently, the data required for credit appraisal is scattered across different entities such as government bodies, banks, and identity authorities, and this is creating problems in the seamless and timely delivery of loans. Therefore, the Unified Lending Interface is designed to simplify the whole process. It aims to minimize the time taken for credit approval, especially for small and rural borrowers.

At the global conference, Shaktikanta further explained the Unified Lending Interface platform was designed in a way that an open architecture with open application programming interfaces (APIs) will allow all financial sectors to connect seamlessly in a ‘plug and play’ model.

“ULI is expected to cater to large unmet demand of credit for various sectors for agriculture and MSME borrowers”, said Das. “This platform facilitates seamless flow of digital information, including land records of various states, from multiple data service providers to lenders. “he added.

This digital platform is a part of the central bank’s digitalization of banking services. This platform will be beneficial for all the costumers, lenders and data service providers. This platform will provide frictionless and tailored credit without any paper-based documentation or physical visits to these financial institutes. Data service providers and lenders will benefit as their scalability and reach will increase.

According to the bankers, the ULI platform is currently developed and handled by the Reserve Bank Innovation Hub which is a subsidiary of the RBI that looks after the innovation in the financial sector of the country. “ULI is expected to cater to large unmet demand of credit for various sectors for agriculture and MSME borrowers”, said Das. However, the tech platform will soon be handed over to the National Payments Corporation of India to oversee.

Shaktikanta Das said that previously there was the trinity of Jan Dhan Accounts, Aadhaar and Mobile Phones also known as JAM. But now, the new trinity will be introduced that includes JAM, UPI and ULI, and Central Bank Digital Currency (CBDC).

“The new trinity, JAM, UPI and ULI, Central Bank Digital Currency (CBDC) to be rolled out gradually, is a revolutionary step in India’s digital public infrastructure journey. This initiative reduces complexity of multiple technical integration, enables borrowers to get the benefit of seamless delivery of credit, quicker turnaround time without requiring extensive documentation,” he further added.